Homestead Tax Credit

Please take note of the following for faster and more efficient service:

Great News! As of Monday, September 11th, 2023, the Homestead Tax CreditEligibility Application is on Maryland One Stop.This means that there is one simple login, and no need for an access codeto fill out the one-time Homestead Tax Credit Application (principalresidence assessment cap).

To file your application:

- Go to:

https://onestop.md.gov/

-

Browse by State Agencies

-

Select Department of Assessments & Taxation

-

Select "Homestead Tax Credit Eligibility Application" and Apply Online

- The Homestead Property Tax Credit application only needs to be filed once during your time in your property. Before calling or emailing the Department, please check SDAT's Real Property search page to determine if you already have a Homestead Tax Credit on file:

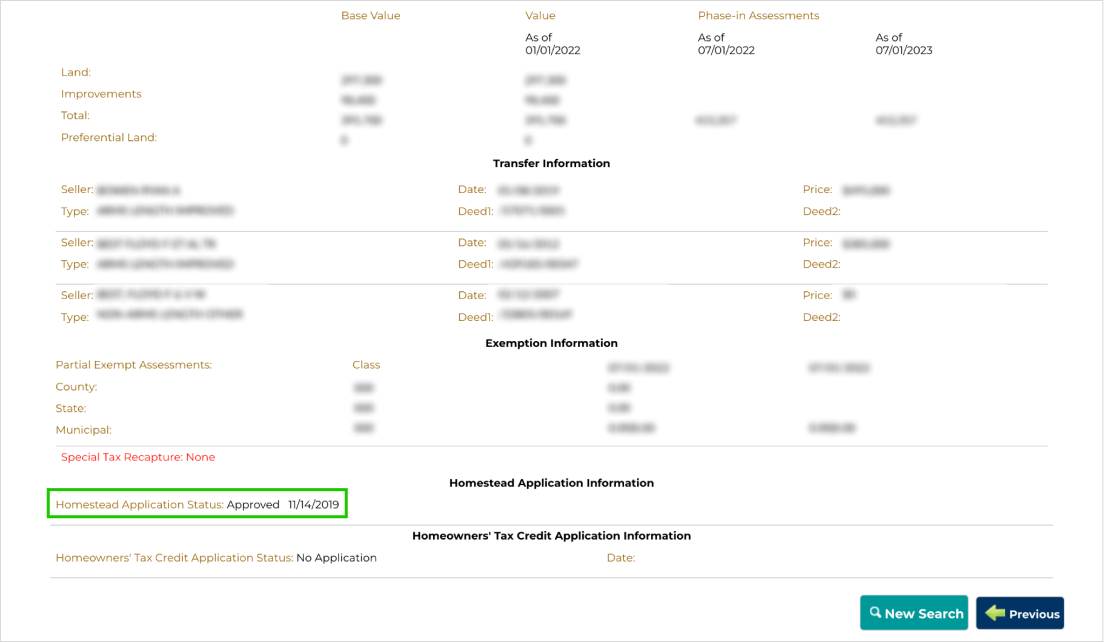

- Once you've accessed your property's page, the status of your Homestead application is located at the bottom of the page.

A status of Approved or Application Received means that no further action is required.

- If the information on your property says, “Homestead Application Status: No Application.” you can file your application online for fastest service:

Alternatively, you can file by mail by downloading, completing, and submitting a

paper application.

paper application.

What is the Homestead Credit?

To help homeowners deal with large assessment increases on their principal residence, state law has established the Homestead Property Tax Credit. The Homestead Credit limits the increase in taxable assessments each year to a fixed percentage. Every county and municipality in Maryland is required to limit taxable assessment increases to 10% or less each year.

View a listing of homestead caps for each local government.

Technically, the Homestead Credit does not limit the market value of the property as determined by the Department of Assessments and Taxation. Instead, it is actually a credit calculated on any assessment increase exceeding 10% (or the lower cap enacted by the local governments) from one year to the next. The credit is calculated based on the 10% limit for purposes of the State property tax, and 10% or less (as determined by local governments) for purposes of local taxation. In other words, the homeowner pays no property tax on the market value increase which is above the limit.

Example:

Assume that your old assessment was $100,000 and that your new phased-in assessment for the 1st year is $120,000. An increase of 10% would result in an assessment of $110,000. The difference between $120,000 and $110,000 is $10,000. The tax credit would apply to the taxes due on the $10,000. If the tax rate was $1.04 per $100 of assessed value, the tax credit would be $104 ($10,000 ÷ 100 x $1.04).

Application Requirement

To prevent improper granting of this credit on rented or multiple properties of a single owner, a law was enacted in 2007 that requires all homeowners to submit a one-time application to establish eligibility for the credit.

Find the status of your Homestead eligibility by looking up your property on the

Real Property database.

Conditions

The tax credit will be granted if the following conditions are met during the previous tax year:

- The property was not transferred to new ownership.

- There was no change in the zoning classification requested by the homeowner resulting in an increase value of the property.

- A substantial change did not occur in the use of the property.

- The previous assessment was not clearly erroneous.

- A further condition is that the dwelling must be the owner’s principal residence and the owner must have lived in it for at least six months of the year, including July 1 of the year for which the credit is applicable, unless the owner was temporarily unable to do so by reason of illness or need of special care. An owner can receive a credit only on one property---the principal residence.

- Razed Dwelling and Vacated Dwelling for Making Substantial Improvements

Property owners who choose to vacate their principal residence to raze the dwelling in order to replace it with a new home on the subject property or to make substantial improvements to the property can continue to receive Homestead Tax Credit eligibility provided two conditions are met. First, the homeowner(s) must have owned and occupied the property as a principal residence for at least 3 full tax years immediately preceding the razing or the commencement of the substantial improvements. Second, the building of the replacement home or making the substantial improvements must be completed within the next succeeding tax year after the tax year in which the razing or the substantial improvements were commenced.

Appeal Rights

If you have been denied a Homestead Tax Credit and you believe that you are eligible, contact the Central Office for the Homestead Tax Credit Program at the telephone numbers listed below. A final denial of a Homestead Tax Credit by the Central Office may be appealed within 30 days to the Property Tax Assessment Appeal Board in the jurisdiction where the property is located.

2021 Legislation

Please note that due to CH333 of the 2021 Maryland Laws, "a contract for the sale of residential property shall include (1) the statement 'If you plan to live in this home as your principal residence, you may qualify for the Homestead Property Tax Credit. The Homestead Property Tax Credit may significantly reduce the amount of property taxes you owe.'; and (2)" the website address https://dat.maryland.gov/homestead. The person conducting the settlement for a buyer of residential property must also present the buyer with a copy of the Homestead Application at the time of settlement. The Department has updated information on that application to include the other new statutory requirements.

Further Information

For questions about the Homestead Tax Credit, email the Homestead unit at sdat.homestead@maryland.gov or you may telephone 410-767-2165 in the Baltimore metropolitan area or at 1-866-650-8783 toll free elsewhere in Maryland.

Please do not Email any tax credit applications to the Department containing personal information, such as social security numbers and/or income tax returns. Instead, please physically mail or fax your completed application and supporting documents to the Department, so your personal information remains confidential.

Revised: November 2023